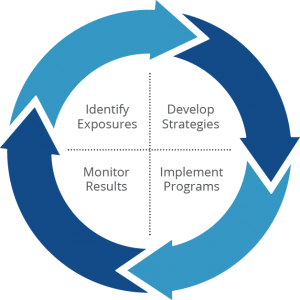

Our Risk Management Process

Our Risk Management Process is a four-step process utilized by Holman and Company to identify, understand, implement and monitor the risk management strategies for you and your business.

Step 1:

Identify Exposures

Step 2:

Define Strategies to Handle Risk

Step 3:

Implementation of Programs

Step 4:

Ongoing Monitoring & Adjustment

Identify Exposures

In the initial phase of identifying exposures, we take the time to work with each client in order to gain a better understanding of your organization and identify your exposures to loss. This process can involve the following:

■ Review of current insurance contracts and program design

■ Inspection of facilities and interviews of key employees

■ Risk Management/Safety Policy review

■ Experience Modification review

■ Accident Analysis and Injury Causation

■ Contract reviews

■ Training and Orientation review

■ Inspection of facilities and interviews of key employees

■ Risk Management/Safety Policy review

■ Experience Modification review

■ Accident Analysis and Injury Causation

■ Contract reviews

■ Training and Orientation review

Define Strategies to Handle Risk

After a thorough understanding of your organization’s exposure to loss, our professionals collaborate with you to outline ways to handle the risks that are identified. These strategies to handle risk can include:

■ Risk Avoidance

■ Contractual Transfer of Risk

■ Retention of Risk

■ Policies/Procedures and Controls

■ Procurement of Insurance Products

■ Appraisal Evaluations

■ Contractual Transfer of Risk

■ Retention of Risk

■ Policies/Procedures and Controls

■ Procurement of Insurance Products

■ Appraisal Evaluations

Implementation of Programs

Once the Risk Strategies are agreed on, we put into place the specially designed tailored programs to protect your assets and the continued revenue generation of your business.

■ Written Service Timelines

■ Specifically Designed Programs

■ Marketing Insurance Program

■ Insurance Policies

■ Loss Control Programs

■ Claims Management

■ Specifically Designed Programs

■ Marketing Insurance Program

■ Insurance Policies

■ Loss Control Programs

■ Claims Management

Ongoing Monitoring and Adjustment

Risk Management is a continual process in which the results of the programs that have been implemented are regularly monitored and any necessary adjustments are made throughout the year. Since organizations and the business environment continually change, it’s critical to stay on top of these changes and make sure your risk management programs adapt as well. The monitoring process involves:

■ Risk Assessments

■ Claims Reviews

■ Experience Modification Reviews

■ Pre-Renewal Strategy Meetings

■ Claims Reviews

■ Experience Modification Reviews

■ Pre-Renewal Strategy Meetings